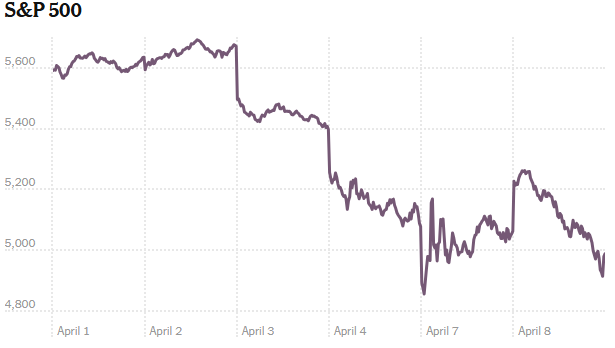

An early rally on Wall Street faded and the S&P 500 ended the day down 1.6 percent after the White House reaffirmed plans to impose high tariffs on China and other countries at midnight.

Another chaotic day of trading on Wall Street ended with a late slide in stock prices, with little letup in the escalating trade tensions and economic anxiety caused by President Trump’s tariffs.

The S&P 500 had posted a big gain at the start of trading, rising as much as 4 percent, but the rally faded and stocks slumped in late trading, ending 1.6 percent lower for the day and adding to a string of losses since Mr. Trump announced sweeping tariffs on countries across the world last week.

Those tariffs are scheduled to take effect at 12:01 a.m. Eastern time Wednesday, the White House reaffirmed on Tuesday, including raising the tax on goods from China to at least 104 percent.

Tuesday’s drop put the benchmark index on the verge of a bear market, defined as a drop of 20 percent or more from its last high. After Tuesday’s drop, the index sits 18.9 percent below its mid-February record, having tumbled more than 12 percent just in the days since Mr. Trump announced his new tariffs.

“The size and disruptive impact of U.S. trade policies, if sustained, would be sufficient to tip a still healthy U.S. and global expansion into recession,” economists from JPMorgan warned at the end of last week.

On Tuesday, investors seemed to take solace in signs that Washington may be open for negotiations on tariffs. Mr. Trump said on social media that he had spoken with the acting president of South Korea and that “things are looking good” after the two discussed tariffs and other issues. But a strong early rally for U.S. stocks faded in the afternoon as it became clear that the administration would move forward with high tariffs on China.

Karoline Leavitt, the White House press secretary, told reporters Tuesday that President Trump had told his advisers to “have tailor-made trade deals with each and every country that calls up this administration to strike a deal.” But she rejected the idea that this was an “evolution” from aides’ earlier comments that there would not be a negotiation over tariffs, with more set to take effect tomorrow. She later reaffirmed the president was not planning to pause his policy. “He expects these tariffs are going to go into effect,” Ms. Leavitt said.

Markets around the world were unmoored last week by Mr. Trump’s announcement of broad new tariffs — a base tax of 10 percent on American imports, as well as significantly higher rates on goods from dozens of other countries set to take effect on Wednesday. Countries have responded with tariffs of their own on U.S. goods, or with threats of retaliation. China retaliated forcefully on Friday, matching a new 34 percent tariff with one of its own on many American imports.

Before markets opened in China on Tuesday, the government unleashed a series of measures to stabilize stocks. In turn, share prices in Hong Kong, a day after plunging 13.2 percent, and in mainland China jumped about 1.5 percent.

Stocks in Japan gained 6 percent, recouping a portion of the previous days’ losses. Markets in Taiwan continued to drop on Tuesday, and after the close of trading the finance ministry there said it would activate a $15 billion stabilization fund to steady the markets.

The Stoxx Europe 600 gained 2.7 percent, with nearly every major market in the region in the green. Stéphane Boujnah, the chief executive of Euronext, which runs several stock exchanges across Europe, said in an interview on French radio that the disruption caused by tariffs had made the U.S. markets “unrecognizable” to investors, who were shifting some of their money to Europe from the United States.

Jane Fraser, the chief executive of Citigroup, said in a memo to employees on Tuesday that she spent last week in Washington and Monday in Mexico “where conversations on the ground are centered on the urgency of the moment.” Although tariffs may eventually be negotiated lower, she said in the note seen by The New York Times, “we should prepare for a fundamental shift in trade and capital flows.”

A survey of small businesses in the United States recorded a decline in confidence for a third straight month, with the share of business owners expecting conditions to improve falling the most since late 2020.

Economic growth worries have been reflected in other markets, notably in the price of oil. Brent crude, the international benchmark, continued to slide on Tuesday, trading at around $63 a barrel; it was above $80 a barrel three months ago.

On Monday, Mr. Trump issued a new ultimatum to China to rescind its retaliatory tariffs on U.S. goods, or face additional tariffs of 50 percent beginning Wednesday. And Scott Bessent, the U.S. Treasury secretary, said in a CNBC interview on Tuesday that China was making “a big mistake” and playing a “losing hand.”

But China is not relenting.

Several government departments and government-owned enterprises pledged to “maintain the smooth operation of the capital market.” And the People’s Bank of China, the country’s central bank, vowed to support Central Huijin Investment, the arm of China’s sovereign wealth fund that said it was increasing its holdings of stock funds.

In addition, dozens of companies, many of which are owned by the government, announced that they were buying back some of their shares, a move that typically lifts stock prices.

It remains to be seen how effective Beijing’s actions will be. The meltdown in Chinese markets a decade ago was driven by a sudden loss of confidence by investors, so propping up stocks helped calm nerves, said Zhiwu Chen, a professor of finance at the University of Hong Kong.

But Mr. Trump’s tariffs could inflict damage on China’s economy. “This time, it is much deeper than just market psychology,” Mr. Chen said.

From : The New York Times